gilti high tax exception election statement

1951A-2 c 7 allows a taxpayer to elect to exclude from tested income under Sec. Final GILTI High-Tax Exception The high-tax exception in Reg.

Gilti High Tax Election A Welcome Alternative To A Section 962 Election Forvis

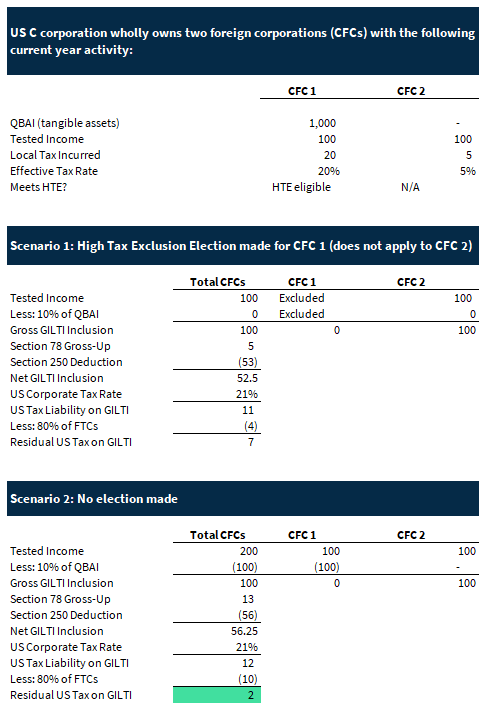

The GILTI high-tax exception would apply separately to each CFC with only the tested income generated by CFC2 meeting the high-tax exception threshold since the effective tax rate on.

. 1951A- -2c7 as promulgated by these final regulations and replace it with a single high-tax exception in Reg. The change would save more than 35 million. The following features of the GILTI high-tax election are expected to limit its utility.

954 b 4 a so-called. Newsom said the preliminary budget he submits in January will include a proposal to exempt the forgiven debt from state taxes. Retroactive high-tax exclusion HTE election to exclude specific controlled foreign corporation gross income from being subject to the GILTI regime to the extent such gross income was.

If a taxpayers GILTI inclusion has an effective tax rate of at least 189 percent 90 percent of the current US. Affirmatively elect to apply the high tax excep tion to exempt both subpart F under IRC 951 and GILTI inclusions Under IRC 951A from US federal income tax if the effective tax rate on. The IRS issued the GILTI high-tax exclusion final regulations on July 20 2020 which were published on July 23 2020 in the Federal Register.

A Voice for Taxpayers. The final regulations retain the consistency rule in the 2019 proposed regulations that generally provides that if a CFC is a member of a controlling domestic shareholder group CFC group a. New GILTI Regulations Include High-Tax Exception Election Change for Partnerships S Corporations.

The final GILTI hightax exception from Reg. Department of the Treasury and. A Documentary Transfer Tax is imposed on all documents that convey real property within the cities of Los Angeles County Per Revenue Taxation.

It would raise billions annually with most going. Retention of the 189 High-Tax Threshold The Final Regulations retain the rule from. Corporate rate of 21 percent calculated based on US.

The California Taxpayers Association has been on the front lines supporting sound tax policy and supporting government efficiency since 1926. Shareholders of CFCs can exclude global income earned in high tax jurisdictions from their GILTI inclusion. On June 14 2019 the US.

Proposition 30 would place a new 175 tax on incomes above 2 million which is estimated to be fewer than 43000 taxpayers. Among the key points of the final regulation. Among the key points are.

Back in July the Treasury Department and IRS issued final regulations concerning the Global Intangible Low-Taxed Income GILTI high tax exclusion that were effective on.

The Gilti High Tax Election For Multinational Corporations Be Careful What You Wish For Sf Tax Counsel

Form 8992 Gilti Calculation Pitfall Latest To Know For 2020

Gilti Regime Guidance Answers Many Questions

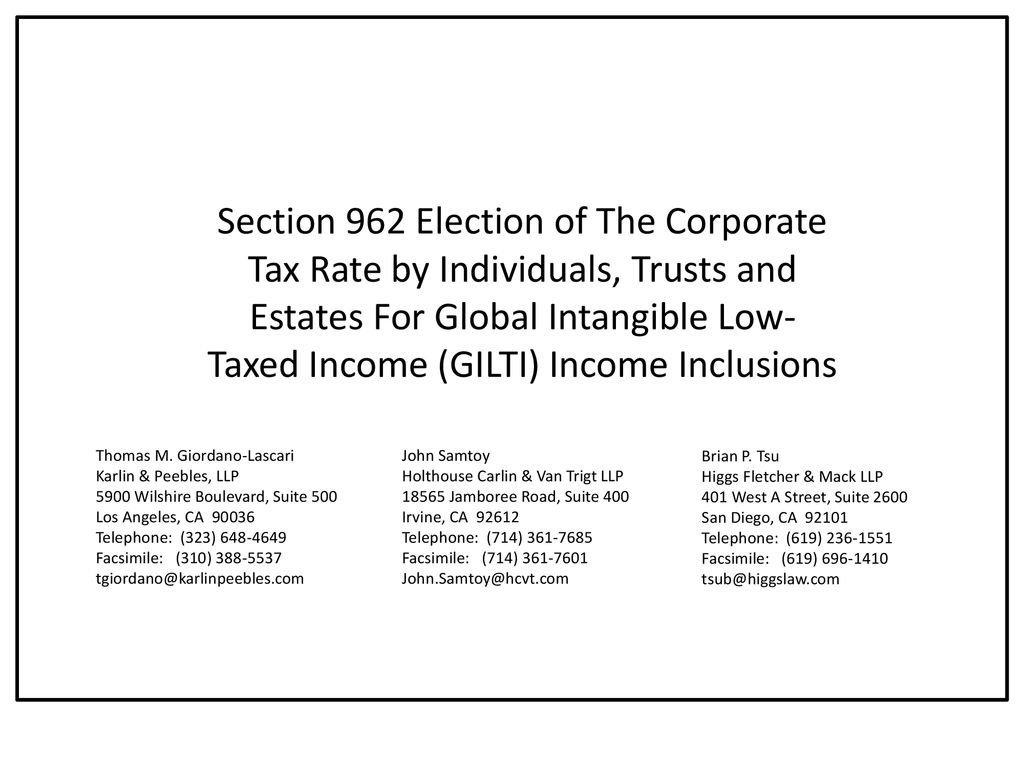

Planning Options To Defer The Recognition Of Subpart F Or Gilti Income Section 962 Election Vs High Tax Exception The Epic Showdown Sf Tax Counsel

Foreign Corporation Taxes And Filing Services Expat Tax Cpas

Latest International Tax Regulations Update Final Gilti High Tax And Fdii Youtube

Demystifying Irc Section 965 Math The Cpa Journal

High Tax Exception To Global Intangible Low Taxed Income 2020 Articles Resources Cla Cliftonlarsonallen

Demystifying Irc Section 965 Math The Cpa Journal

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

Section 962 Election Of The Corporate Tax Rate By Individuals Trusts And Estates For Global Intangible Low Taxed Income Gilti Income Inclusions Thomas Ppt Download

Final Regulations Clarify Potential Benefits Of The Gilti High Tax Exclusion Our Insights Plante Moran

The Costs And Benefits Of The Gilti High Foreign Tax Exception Accounting Services Audit Tax And Consulting Aronson Llc

Let S Talk About Form 5471 Information Return Of U S Persons With Respect To Certain Foreign Corporations Htj Tax

Harvard Yale Princeton Club Ppt Download

Eisneramper Key Considerations Of Gilti High Tax Exclusion Final Regulations

Gilti High Tax Exception Final Regulations

Latest International Tax Regulations Update Final Gilti High Tax And Fdii Youtube